Custom Applications For Risk Management, Peer Benchmarking, And Idea Generation

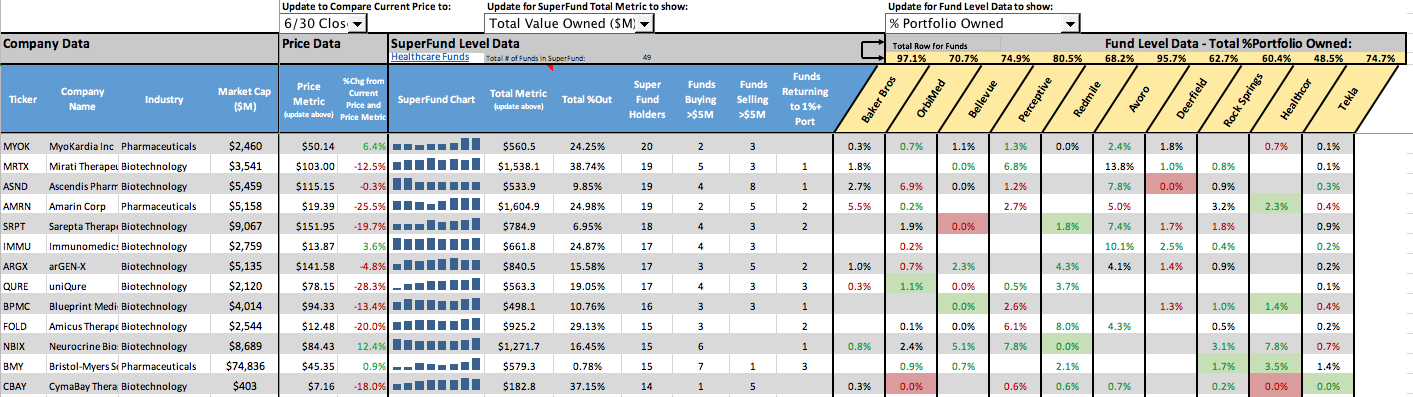

SuperFunds:

Aggregate quarterly buying/selling trends at your favorite funds, peers, and competitors; easily see where Healthcare, TMT, Tiger-related, Value, and other funds are making their biggest bets.'Crowd-Viction' Reports:

Proprietary screens for companies where multiple 'fundamental' funds are: making sizable portfolio bets ('convicted') or control a sizable percent of the company ('crowded'); get ahead of similar sell side reports.Fund Overlap Analysis:

Benchmark your fund's holdings against peers to understand common positions and the percentage overlap (or lack of) for top holdings.13F Screening:

Screen across all 13F activity for advanced concepts like biggest portfolio bet in 2+ years, returning positions, conviction selling, and much more.Sector Specialist Reports:

Quarterly reports by our Research Team, highlighting notable activity at some of the most followed Healthcare, TMT, and Value funds.13D/G Monitoring:

Detailed screening for 13D and 13G filings, including isolating 13Ds with letters or searching over the 13D purpose; also available in a recurring report format.Fund Tearsheets:

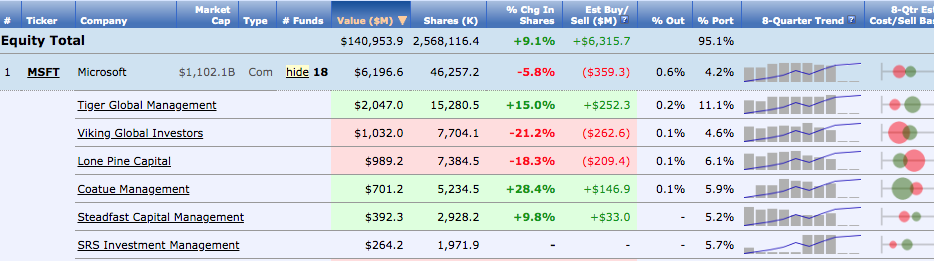

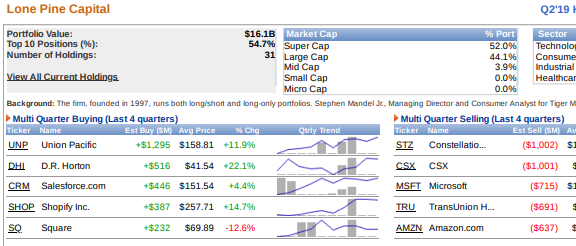

Analyze any fund's largest holdings and biggest buys/sells, including 8-quarter and estimated cost/sell basis charts; typically sent to clients within minutes of 13Fs being filed.

Excel Library: Build on Our Core Templates for Advanced Analysis

-

Custom 13F Templates:

If you do any Excel work or data manipulation with 13Fs - we can build views for you to achieve faster and more comprehensive analysis. We help around 100 clients with custom 13F outputs each quarter. -

13F Ownership Peer Matrix:

The best way to analyze consensus activity across a basket of funds (sector specialists / peer funds, etc.) against your portfolio or coverage; view potential overlap (or lack of) at top holdings.

-

'Crowd-Viction':

Screen for companies where multiple 'fundamental' funds are: making sizable portfolio bets ('convicted') or control a sizable percent of the company ('crowded'); get ahead of similar sell side reports. -

13F Ideas:

Isolate conviction fund buying / selling across your Watchlist and identify notable fund behaviors such as "Returning" or "Biggest Bet" positions.

Supercharge Your 13F/D/G Workflow Today